Track Spending

Tracking your spending must be done if you hope to get a handle on where your money is going in your life

This can be accomplished by using one kind of payment system. Whether you choose a credit card, a debit card, or cash, use that item on everything you buy and then print off that statement at the end of the month. Categorize your spending and move on to point #2.

Use the tracking spending excel sheets below.

These excel spreadsheets have formula’s built in to simply the calculations. All you have to do is input the data. Customize them any way you want. You could also use mint.com or powerwallet.com to accomplish the same task if you like. The key is to do it and do it now. Make it simple and sustainable and it will last a lifetime!

Track your spending for 2 or 3 months to help you identify a budget that will work for you

When you track your spending it will provide you an opportunity to evaluate how your money is being spent. Does it match your values, and self-perception of who you are? Take a good hard look in the mirror. Does your spending reflect the person you want to be?

Complete a Net Worth statement one time each year to track how you are doing financially.

Far too many people gauge their financial situation based on the stuff in their lives (new car, big boat, giant home, etc.) and the size of their paycheck. That is a mistake. Many people with a lot of stuff and big incomes file bankruptcy. It’s how much you end up keeping that will ultimately matter. The Net Worth Statement is the best way to see how you are doing financially. See examples below. You simply identify the value of your assets (stocks, bonds, cash, home, car, etc.) and subtract your liabilities (car loan, home loan, student loan, credit card debt, etc.).

The Net Worth statement shows you where you are, not where you are going.

Do not beat yourself up if your net worth is currently in the negative category. My first one was negative as well. Identify how you got you here and how you can improve the situation. Here are the basics: pay down debt and gradually over time, save money into appreciating assets like stocks, bonds and real estate. Buy those assets using no-load index mutual funds. More on that later in other pages of this website.

Produce a financial plan that will take you where you want to go.

Identify your dreams, write them down as goals, and design a plan to achieve them. Focus on making short-term goals (something you can accomplish in less than 1 year) and long-term goals (beyond 1 year). Make them as specific as possible (I will save $200 into my Vanguard Roth IRA Target 2040 Fund for example) and then use them to drive your daily behaviors and ultimately your life long habits.

You can further your education by reading these three books:

- Financial Happine$$ by Mike Finley

- Personal Finance for Dummies by Eric Tyson

- Your Money or Your Life by Vicki Robin and Joe Dominguez

Keep learning you find the teachers (and avoid the salespeople) that will guide you to a better tomorrow. Believe in that, and believe in you.

Financial Plan Example

My Current Status

- My assets equal $28,450

- My Liabilities equal $10,230 (student loans)

- My Net Worth is $18,220

- My current asset allocation is 80% stocks and 20% bonds/cash (no change needed)

Insurance Needs

- I don’t need life insurance at this time

- I have full coverage on the truck with the highest deductible ($1,000)

- I don’t need rental property insurance at this time (I don’t have much to steal)

- The job covers my health insurance with no deductible

Financial Goals (this year)

- Put 100% of my 401K contributions in the 2040 Target Retirement Fund

- Change my 401K contributions to 20% of my gross pay.

- Read 2 of the personal finance books on the list stated below

- Monitor my expenses very carefully. Now is the time to sacrifice.

- Keep my tracking document updated and focus on what is really important to me.

- Live below my means today so one day I can live well above my means!

- Empty my savings except for $1,000. Put everything else towards the school loans.

- Starting on 1 February start paying down $1,000 on my student debt loans per month.

- Select the smallest loan and pay that off first.

- Proceed to the next smallest and pay that off. Continue this process until they are all paid off.

- Take my tax refund check and put it all towards my student loans.

- I will not pick up any more debt this year!

- I will go back and fill up my emergency account.

- Once I have $3,000 I will move it the Total Bond Market Index Fund at Vanguard.

- Once the emergency fund is full, I will start my Roth IRA.

- I will go to Vanguard and open up the Target Retirement 2020 Fund (VTXVX) with $1,000.

- I will set up an automatic investment into this fund of $400 per month.

- I will have the money automatically taken out of my bank account month after month.

- I will ignore the day-to-day ups and downs of the stock and bond markets.

- I will start looking at buying a home when the account reaches $10,000.

Financial Goals (into the future)

- Buy a home around the year 2020

- Max out my 401K and my Roth IRA each and every year

- Buy a better car in 2018 with cash that I saved up in my emergency account

- Find a wife who has a similar perspective on money as I do (not materialistic)

- Read at least 2 financial books each year.

Net Worth Example

| Assets | Estimated Value |

| Cash | 189 |

| CheckingAccounts | 210 |

| Savings Accounts | 720 |

| Company Retirement Plans | 23460 |

| IRA's | 4100 |

| Personal Possessions | 8000 |

| Cash Value of Life Insurance Policy | 4500 |

| Annuities | 6000 |

| Market Value of Vehicles | 10400 |

| Rental Property | 0 |

| Market Value of Personal Home | 160000 |

| Total | 217579 |

| Liabilities | Estimated Value |

| Mortgage Loan | 132000 |

| 2nd Mortgage | 22000 |

| Student Loans | 26600 |

| All Credit Card Debt | 14700 |

| Loan to Mom/Dad/Uncle/Aunt | 800 |

| Boat Loan | 15000 |

| Personal Loans | 2000 |

| Car Loans | 8200 |

| Other Loans | 12600 |

| Total | 233900 |

| Net Worth | -16321 |

| Assets | Estimated Value |

| Cash | 30 |

| CheckingAccounts | 210 |

| Savings Accounts | 5 |

| Bonds Outside of Retirement | 14400 |

| Stocks Outside of Retirement | 45800 |

| Company Retirement Plans | 98400 |

| IRA's | 59200 |

| College Savings Accounts | 22100 |

| Personal Possessions | 8000 |

| Cash Value of Life Insurance Policy | 0 |

| Annuities | 0 |

| Market Value of Vehicles | 10400 |

| Market Value of Personal Home | 160000 |

| Total | 418545 |

| Liabilities | Estimated Value |

| Mortgage Loan | 132000 |

| 2nd Mortgage | 0 |

| Student Loans | 0 |

| All Credit Card Debt | 0 |

| Loan to Mom/Dad/Uncle/Aunt | 0 |

| Boat Loan | 0 |

| Personal Loans | 0 |

| Car Loans | 0 |

| Total | 132000 |

| Net Worth | 286545 |

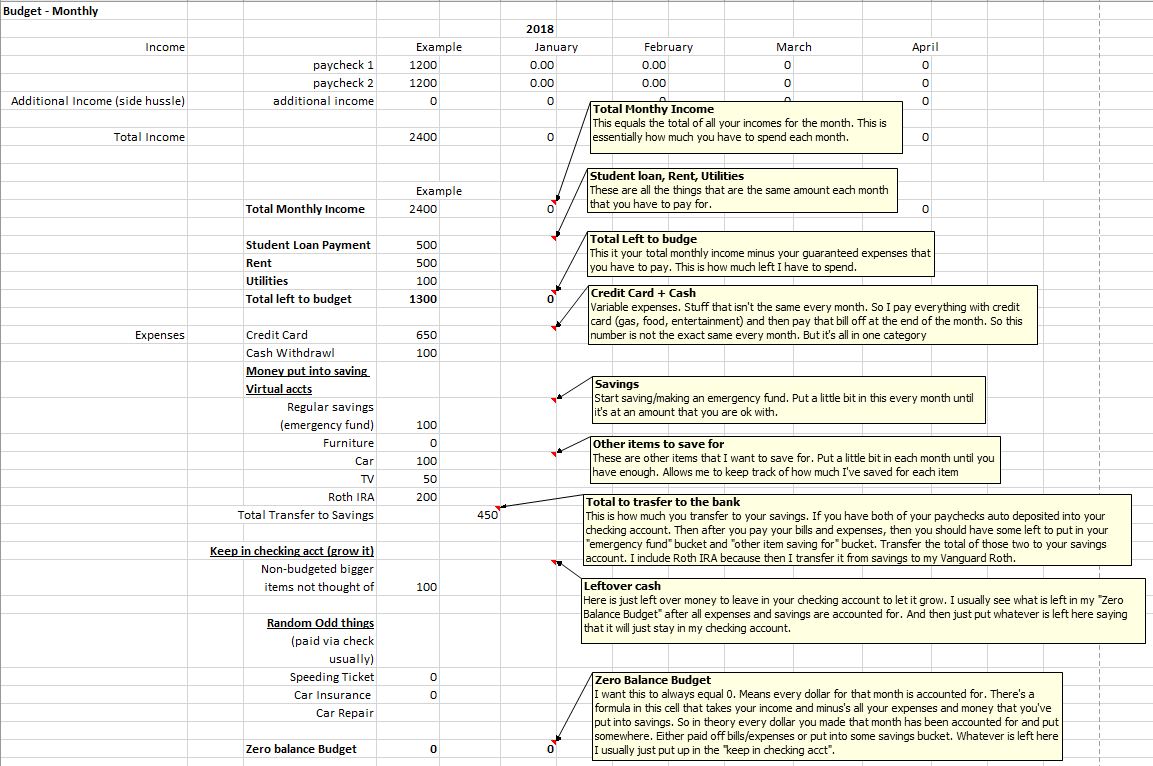

Budget Spreadsheet Examples

A couple templates for tracking expenses and/or budgeting. Feel free to download and edit/make your own. Best thing you can do is just get started.

Budget Template 1

- Save as

- xlsx

| Category | Amount | Due | January | February | March | April | May | June | July | August | September | October | November | December | Totals |

| Savings | 600 | 1st | 0 | ||||||||||||

| Utilities | 215 | 5th | 0 | ||||||||||||

| Health Insurance | 407 | 5th | 0 | ||||||||||||

| Condo Fees | 120 | 5th | 0 | ||||||||||||

| Car Insurance | 80 | 6th | 0 | ||||||||||||

| Cell Phone | 75 | 6th | 0 | ||||||||||||

| Cable | 77.13 | 10th | 0 | ||||||||||||

| Gym Membership | 45 | 27th | 0 | ||||||||||||

| FICA Tax | 386.45 | N/A | 0 | ||||||||||||

| Federal/State Tax | 645.66 | N/A | 0 | ||||||||||||

| Total Fixed | 2651.2400 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Groceries | 404.22 | N/A | 0 | ||||||||||||

| Gas | 112.35 | N/A | 0 | ||||||||||||

| Eating Out | 172 | N/A | 0 | ||||||||||||

| Home/Yard Maint | 132.24 | N/A | 0 | ||||||||||||

| Gifts/Charity/Church | 80 | N/A | 0 | ||||||||||||

| Clothing | 156.41 | N/A | 0 | ||||||||||||

| Fun | 184.83 | N/A | 0 | ||||||||||||

| Other | 55.14 | N/A | 0 | ||||||||||||

| Total Flexible | 1297.19 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Total Fixed/Flexible | 3948.4300 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Paycheck | 3955 | 0 | |||||||||||||

| Total | 3955 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Income - Expenses | 6.5700 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Vacations | 1000 | June | |||||||||||||

| Car Registration | 320 | October | |||||||||||||

| Christmas/Birthdays | 600 | All year | |||||||||||||

| One Time Expenses | 1920 |

Budget Template 2

Just a screenshot of the comments explaining the 2nd template as they do not show up in the downloaded version.

Downloadable Budget Template 2

- Save as

- xlsx

| Budget - Monthly | ||||||||||||

| 2018 | ||||||||||||

| Income | Example | January | February | March | April | |||||||

| paycheck 1 | 1200 | 0 | 0 | 0 | 0 | |||||||

| paycheck 2 | 1200 | 0 | 0 | 0 | 0 | |||||||

| Additional Income (side hussle) | additional income | 0 | 0 | 0 | 0 | 0 | ||||||

| Total Income | 2400 | 0 | 0 | 0 | 0 | |||||||

| Example | ||||||||||||

| Total Monthly Income | 2400 | 0 | 0 | 0 | 0 | |||||||

| Student Loan Payment | 500 | |||||||||||

| Rent | 500 | |||||||||||

| Utilities | 100 | |||||||||||

| Total left to budget | 1300 | 0 | 0 | 0 | 0 | |||||||

| Expenses | Credit Card | 650 | ||||||||||

| Cash Withdrawl | 100 | |||||||||||

| Money put into saving Virtual accts | ||||||||||||

| Regular savings (emergency fund) | 100 | |||||||||||

| Furniture | 0 | |||||||||||

| Car | 100 | |||||||||||

| TV | 50 | |||||||||||

| Roth IRA | 200 | |||||||||||

| Total Transfer to Savings | 450 | 0 | 0 | 0 | 0 | |||||||

| Keep in checking acct (grow it) | ||||||||||||

| Non-budgeted bigger items not thought of | 100 | |||||||||||

| Random Odd things (paid via check usually) | ||||||||||||

| Speeding Ticket | 0 | |||||||||||

| Car Insurance | 0 | |||||||||||

| Car Repair | ||||||||||||

| Zero balance Budget | 0 | 0 | 0 | 0 | 0 |