Taxes

You can complain about taxes or do something about them

Complaining will get you nowhere. Educate yourself on the topic and come up with a tax plan to reduce your tax burden at the federal and state levels. You can do this on your own and/or you can identify a tax professional and work closely with that person in designing a tax reduction plan that takes you into the future for many decades.

The federal income tax kicks in after your standard deduction

For example, a single person has a $12,200 standard deduction. This means the first $12,200 you make in earned income is federal income tax free (you will still pay FICA tax on that income, which goes toward Social Security and Medicare). Your federal taxable income starts after $12,200. This number will be different based on your filing status (head of household and married filing jointly for example).

| Tax rate | Taxable income bracket | Tax owed |

| 0.1 | $0 to $9,525 | 10% of taxable income |

| 0.12 | $9,526 to $38,700 | $952.50 plus 12% of the amount over $9,525 |

| 0.22 | $38,701 to $82,500 | $4,453.50 plus 22% of the amount over $38,700 |

| 0.24 | $82,501 to $157,500 | $14,089.50 plus 24% of the amount over $82,500 |

| 0.32 | $157,501 to $200,000 | $32,089.50 plus 32% of the amount over $157,500 |

| 0.35 | $200,001 to $500,000 | $45,689.50 plus 35% of the amount over $200,000 |

| 0.37 | $500,001 or more | $150,689.50 plus 37% of the amount over $500,000 |

| Tax rate | Taxable income bracket | Tax owed |

| 0.1 | $0 to $19,050 | 10% of taxable income |

| 0.12 | $19,051 to $77,400 | $1,905 plus 12% of the amount over $19,050 |

| 0.22 | $77,401 to $165,000 | $8,907 plus 22% of the amount over $77,400 |

| 0.24 | $165,001 to $315,000 | $28,179 plus 24% of the amount over $165,000 |

| 0.32 | $315,001 to $400,000 | $64,179 plus 32% of the amount over $315,000 |

| 0.35 | $400,001 to $600,000 | $91,379 plus 35% of the amount over $400,000 |

| 0.37 | $600,001 or more | $161,379 plus 37% of the amount over $600,000 |

The federal income tax is progressive

This simply means your income is taxed at different amounts as it goes up over time. Everyone has a percentage of their income taxed at 10%, then 15%, then 25% and so on based on how much you actually earn. Don’t worry about reaching higher tax brackets. Put your energy into designing a tax plan that reduces those taxes as the money comes in. One of the best ways to reduce your taxes (you are deferring it into the future) would be to invest 20% of your income in a pre-tax 401(k), 403(b), TSP, or 457 at work. This will decrease your taxes AND increase your money saved for your future needs.

When investing outside of retirement accounts, focus on investments that provide long term capital gains and qualified dividends

These two types of passive income are taxed at a much lower rate (0% – 20% based your income). This can be achieved by investing in those very efficient and low turnover no-load index mutual funds (focus on stock funds like the Total Stock Market Index Fund and the Total International Stock Index Fund at Vanguard for example). As a general rule, focus on investing in your retirement accounts (at work and outside of work in a Roth IRA) prior to investing in taxable accounts.

Understand your marginal federal and state tax rate (how your last dollar is taxed) so you can reduce your effective tax rate (the percentage in taxes you ultimately pay in relation to your income)

For example, if you were single and made $70,000 in Iowa, in 2015, your marginal tax rate would be 33.98% (25% federal and 8.98% state). With some tax planning and funding of your traditional pre-tax retirement account at work, you might be able to knock your effective tax rate down to something below 10%! Take control of the situation or Uncle Sam will!

You pay tax on many, many things, don’t just focus on the income tax

When looking to reduce your tax burden, focus your energy on the entire tax picture. You can reduce your taxes by driving less, eating out less often, buying less stuff, buying less home, buying expensive vehicles less often, focusing more on passive income, eliminating smoking, drinking less, and on and on the list will go. Remind yourself, your daily habits are taxed. An easy way to reduce your future taxes would include investing in a Roth IRA. All of the earnings will be tax free when you pull the money out at a later date (59.5 years of age or under certain exceptions) as long as they are qualified (been in there for 5 years). The Roth IRA is a must for most people!

Tax credits are great and tax deductions are good

The tax credit provides you a dollar for dollar tax savings. It doesn’t get better than that. The tax deduction provides you a reduction in tax based on your marginal tax rate and your income. This is good only if the deduction is moving you forward in life. Do not chase after tax deductions just because they are tax deductions. Getting back 30 cents on the dollar is only a good deal when it improves your situation. Learn more about the different types of tax credits here: http://www.irs.com/articles/refundable-vs-non-refundable-tax-credits

Understand how tax withholding works

When you get a job they will ask you to fill out a W-4. This form identifies how much tax you want withheld from your income. If you put 0, you will have the maximum taken out and you will get a big fat tax refund (bad idea as you are just getting your money back with no interest). You may consider 2, 3, 4 or more allowances based on your individual tax situation. You want to consider your income level, personal exemptions, other dependents, tax deductions, and tax credits when deciding on this number. To run the numbers on a calculator, go here: http://apps.irs.gov/app/withholdingcalculator/

Consider doing your own taxes at least one time in your life

If you want to understand taxes and how they are affecting your life, doing your own taxes will help. For many people, this can be an informative and inexpensive way to become more knowledgeable about the tax code. At some point when your tax life becomes more complicated, you might consider using a tax professional. If you do, work with them to understand the situation. Do not just hand over your records and ask for a big refund. To learn more about doing your federal taxes for free (income under $62,000 required), go here: http://www.irs.gov/uac/Free-File:-Do-Your-Federal-Taxes-for-Free

Taxes are used by governments to provide the services its citizens want and need

Keep this in mind when looking at all of the taxes you pay. Sometimes the money is used wisely by our government officials and sometimes it is not. There is much about government you and I have little control over. There is a lot that we can do when it comes to how we live our daily lives and manage our money. Focus your efforts on what you can control and what behaviors will reduce your tax burden. Learn more about your state here: http://www.kiplinger.com/tool/retirement/T055-S001-state-by-state-guide-to-taxes-on-retirees/.

2019 Federal Tax Table

| Criteria (2019) (for taxes due April 2020) | Single | Married filing jointly | Long-Term Capital Gain Rate | Qualified Dividends | Short-Term Capital Gains/Ordinary Dividends | Social Security | Medicare |

| Standard Deduction | 12200 | 24400 | N/A | N/A | N/A | 0.062 | 0.0145 |

| 10% Tax Bracket | $0 - $9,700 | $0 - $19,400 | 0 | 0 | 0.1 | 0.062 | 0.0145 |

| 12% Tax Bracket | $9,701 - $39,475 | $19,401 - $78,950 | 0 | 0 | 0.12 | 0.062 | 0.0145 |

| 22% Tax Bracket | $39,476 - $84,200 | $78,951 - $168,400 | 0.15 | 0.15 | 0.22 | 0.062 | 0.0145 |

| 24% Tax Bracket | $84,201 - $160,725 | $168,401 - $321,450 | 0.15 | 0.15 | 0.24 | 132900 | 0.0145 |

| 32% Tax Bracket | $160,726 - $204,100 | $321,451 - $408,200 | 0.15 | 0.15 | 0.32 | 0 | 0.0145 |

| 35% Tax Bracket | $204,101 - $510,300 | $408,201 - $612,350 | 0.15 | 0.15 | 0.35 | 0 | 0.0235 |

| 37% Tax Bracket | Beyond $510,301 | Beyond $612,251 | 0.2 | 0.2 | 0.37 | 0 | 0.0235 |

Understand Single, Married, Head of Household

Most common are single or married, filing jointly.

Summary:

Head of Household

- Unmarried person, who has to provide for others, typically by paying for a house and supporting children, or others

- It gets you a little more of a standard deduction compared to filing single (singe $12,000 vs head $18,000)

Married, filing jointly

- Most married couples

- You combine incomes and deduct your combined allowable deductions and credits

- Probably lowers your tax bill than if you file separately, you can take some deductions and credits that aren’t available if you file separately

Married, filing separately

- High earners who are married, typically used if going through a divorce or other spouse has some outstanding tax issues

- Typically pay more in taxes than if you file jointly because:

- You can’t deduct student loan interest

- You can’t take credit for a child

- You can’t take earned income credit

- You can’t take the American opportunity or lifetime learning credit

- You can’t take the Traditional IRA deductions

- You can’t deduct Roth IRA contributions

- You can only take half the standard deduction, child tax credit, or deduction for retirement savings contributions

- You can only deduct $1,500 of capital losses instead of $3,000

- If your spouse itemizes, you have to itemize to, even if the standard deduction would get you more. You’ll also have to decide which souse gets the deduction, which can be complicated

- Note: If you and your spouse are both high income earners, you don’t qualify for any of those deductions/credits anyway, so this may be a consideration.

Single

- Unmarried people who don’t qualify for any other filing status

- Standard deduction of $12,200 for tax year 2019

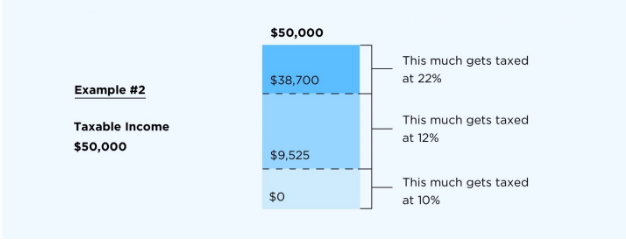

Understand Progressive System

- Progressive system – meaning people with higher incomes pay higher federal income tax rates

- Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make

- You divide your TAXABLE income into chunks (brackets) and each chunk gets taxed at the corresponding rate

- Say you made 62,200 as a salary, then minus the standard deduction for single person your taxable income is $50,000.

- You would pay 10% on the first $9,700. Then pay 12% on income between $9,701 and $39,475. And then 22% on the remaining income up till your total of $50,000

Understand Capital Gains

Capital gains are profits from the sale of an asset. Such as stock, land, business, etc. It depends how long you held the asset before selling. It’s better to have held it longer than a year. Capital gains usually applies to investments (stocks, bonds, real estate investments), cars, boats, etc.

- Short-term capital gains tax – taxes on the assets sold when asset was held for one year or less. See table above, but it is usually in the 22%, 24%, etc

- Long-term capital gains tax – taxes on the assets sold when asset was held for more than a year. See table above but it is usually in the 15% range.

Note: you may owe an additional 3.8% if this rules applies: Will owe the 3.8% on whichever one of these is smaller: your net investment income, or the amount by which your modified gross income exceeds the amounts listed below:

Single: $200,000

Married, jointly: $250,000

Married, separately: $125,000

How to minimize capital gains taxes

- Hold on to asset for a year or longer

- Exclude home sales, if you’ve lived in it for at least two years, you can exclude up to $250,000 (single) and $500,000 (married jointly).

- Rebalance with dividends. Reinvest them in the under performing investment instead of the “winner’ where they came from. This will help you avoid selling strong performers and thus avoid capital gains that would come from that sale

- Use tax-advantaged accounts. 401(k), IRA, 529 plans, your investments can grow tax-free or tax-deferred.

Understand Tax Credit

Money given back to you if you qualify. Instead of deduction which just lowers your taxable income. If you qualify for a credit, you get the actual dollar value back.

- Child tax credit

- Created to help with cost of babysitting/daycare

- Provides up to 35 percent of qualifying expense, depending on adjusted gross income

- $2,000 per qualifying child and is refundable up to $1,400 subject to phaseouts. Phaseouts, which are not indexed for inflation, will begin with adjusted gross income (AGI) of more than $400,000 for married jointly, and more than $200,000 for all other taxpayers.

- Earned Income Tax Credit

○ To help offset the burden of Social Security taxes and to provide an incentive to work

○ It’s determined by income and is phased in based on your filing status

○ Is setup for the service-sector person or blue-collar worker, usually lower earning jobs

○ maximum amount is $6,557 for married jointly who have three or more children. (if married couple AGI is less than $54,998) - Adoption credit

○ $14,080 for adopting child with special needs, $13,810 for other adoptions - Foreign earned income exclusion

○ If you paid some tax with a foreign investment - American Opportunity credit

○ Depending on income, you can receive up to $2,500 for cost of qualified tuition and course materials

○ Must be at least half-time student

○ AGI of $80,000 or less (single) or $160,000 (married, jointly) - Savers Tax Credit

○ Depending on income, you can get a tax credit if you put money into qualified retirement accounts

○ Qualify for up to $1,000 (single) and $2,000 (married, jointly)

○ Income cannot be over $31,500 (single) and $63,000 (married, jointly)

Understand Tax Deduction

You can try to add all these deductions up, if they equal more than your standard deduction.

| Medical Expenses | You can deduct qualified, unreimbursed medical expenses that are more than 7.5% of your adjusted gross income for the tax year |

| Deduction in state and local taxes | You may deduct up to $10,000 (married, jointly) for a combination of property taxes and either state and local income taxes |

| Mortgage interest | Whatever you paid in mortgage interest, you can deduct from your income when filing federal taxes at end of the year |

| IRA contributions | You may be able to deduct contributions to traditional IRA, though eligibility determined by income level and if you or your spouse is covered by a retirement plan at work (see traditional vs roth page) |

| 401(k) contributions | Usually already on your W2 statement, but whatever you put into your 401(k) straight out of your paycheck, is already deducted from your federal taxes $19,000 is max you can put into your 401(k) for 2019, $24,500 if you're 50 or older |

| Heath Savings Account contribution | Contributions are tax-deductible, and withdrawals are tax-free. For a high deductible plan for single, you can contribute $3,450. For a high deductible plan for family, you can contribute $6,900 |

State Taxes

Works the same was as federal. Take your income minus your standard deduction (or itemized). Then taxed progressively down the table.

| 2019 Iowa Tax Brackets (Single) | 2019 Iowa Tax Brackets (Joint) | 2019 Iowa Marginal Tax Rates | 2019 Iowa Short Term Capital Gains and Dividend Rates | 2019 Personal Deduction |

| $0+ | $0+ | 0.0036 | 0.0036 | Single is $2,030 |

| $1,598+ | $1,598+ | 0.0072 | 0.0072 | Married is $5,000 |

| $3,196+ | $3,196+ | 0.0243 | 0.0243 | |

| $6,392+ | $6,392+ | 0.045 | 0.045 | |

| $14,382+ | $14,382+ | 0.0612 | 0.0612 | |

| $23,970+ | $23,970+ | 0.0648 | 0.0648 | |

| $31,960+ | $31,960+ | 0.068 | 0.068 | |

| $47,940+ | $47,940+ | 0.07920000000000001 | 0.07920000000000001 | |

| $71,910+ | $71,910+ | 0.0898 | 0.0898 |

| 2019 Minnesota Tax Brackets (Single) | 2019 Minnesota Tax Brackets (Joint) | 2019 Minnesota Marginal Tax Rates | 2019 Minnesota Short Term Capital Gains and Dividend Rates | 2019 Personal Deduction |

| $0+ | $0+ | 0.0535 | 0.0535 | Single is $6,500 |

| $25,890+ | $37,850+ | 0.07049999999999999 | 0.07049999999999999 | Married is $13,000 |

| $85,060+ | $150,380+ | 0.0785 | 0.0785 | |

| $160,020+ | $266,700+ | 0.0985 | 0.0985 |

Tax Terms

| Terms | Defined |

| Tax Deduction | Provides you a reduction on your taxes relative to your actual marginal tax rate. Not as good as a tax credit. |

| Tax Credit | Provides you tax reduction dollar for dollar. As good as it gets. The very best are the refundable tax credits. |

| Refundable Tax Credit | Refunded even if you hit $0. This simply means the government pays you even if you owe no tax whatsoever. Count your lucky stars! |

| Non-Refundable Tax Credit | When you hit $0, you stop. There is no tax benefit once you hit $0 taxes owed. |

| Personal Exemption | The tax deduction you receive automatically when filing. (state taxes) |

| Standard Deduction | The tax deduction you receive automatically when filing. (both state and federal) |

| Itemized Deductions | Deductions that if greater than the standard deduction, can reduce your taxes even more. Home ownership is usually required. |

| Free Tax Filing | Based on income, you can go to irs.gov and hit on free file to complete your tax return for free with income under $62,000 in 2015. |

| Income Tax | The federal government and most states require you to pay a tax on your earned income (job). |

| FICA Tax | 7.65% of each paycheck goes toward funding two very large federal programs: Social Security and Medicare. |

| Tax Withholding | Money withheld from your income. The W-4 is submitted by the individual as they identify the right amount of withholding. |

| Allowances | The W-4 is used to identify how many allowances you need to cover your taxes for the year. Ranges from 0 - 9. Tax exempt? |

| Tax Refund | You had too much withheld so you get your own money back. Avoid this by increasing your allowances on your W-4. |

| Marginal Tax Rate | How your last dollar is taxed. If you were single and made $70,000 in Iowa, your federal/state marginal tax rate would be 31.92%. |

| Effective Tax Rate | Ultimately, what you actually paid in taxes (federal and/or state) in relation to your income. |

| Taxes you pay in Iowa | How much? | How to reduce your taxes? | |

| Income Tax | .36% - 8.98% | *State of Iowa tax rates | Save in retirement accounts (401k and Roth IRA) that defer/eliminate taxes. |

| FICA Tax (Social Security and Medicare) | 0.0765 | *Business owner pays twice the amount and then receives a credit for half of it | Focus on earning passive income (outside of work) that is not taxed by FICA. |

| Sales Tax | 6% + 2% | Buy less stuff and eat out less often. | |

| Gas Tax | 49.4 cents per gallon | *Federal at 18.4 and Iowa at 31 cents per gallon | Drive less and/or own vehicles that take you further on a gallon of gas. |

| Property Tax | 0.0135 | *Tax rate in Cedar Falls, Iowa. It is different based on where you live. | Buy less home. Property tax is based on the value of your residence. |

| 1 Time Vehicle Registration Tax | 0.05 | *Based on the value or size of vehicle after any trade ins | Buy vehicles less often. |

| Yearly Vehicle Registration Tax | $50 - 1% | *1% for the first 7 years in Iowa, goes down from there | Buy older and less expensive vehicles. |

| Inheritance Tax | 1% to 15% | *Not applicable in Iowa to family members. | Plan accordingly and share the estate prior to death with the people you love. |

| Cigarette Tax | $1.36 per pack | Eliminate it or reduce it. You win in multiple ways. | |

| Liquor Tax | $12.43 per gallon | Eliminate it or reduce your consumption of alcohol. | |

| Corporate Income Tax | 6% - 12% | Design a tax plan that works within the business model of your company. | |

| Hotel Tax | 0.05 | The more hotel stays, the more taxes you will pay. | |

| Car Rental Tax | 0.05 | Rent a car only when it is absolutely necessary. | |

| Lottery | ????????? | Don't play it. It's a suckers bet! |